Investing can seem like a daunting task for beginners, but it doesn’t have to be. With the right knowledge and guidance, anyone can start investing and build wealth over time. In this article, we will cover the basics of investing for beginners to help you get started on your journey to financial success.

The first step in investing is to understand what investing actually means. Investing is the act of putting your money into assets with the expectation of earning a profit in the future. This can include stocks, bonds, real estate, and other financial instruments. The goal of investing is to grow your wealth over time by earning a return on your investments.

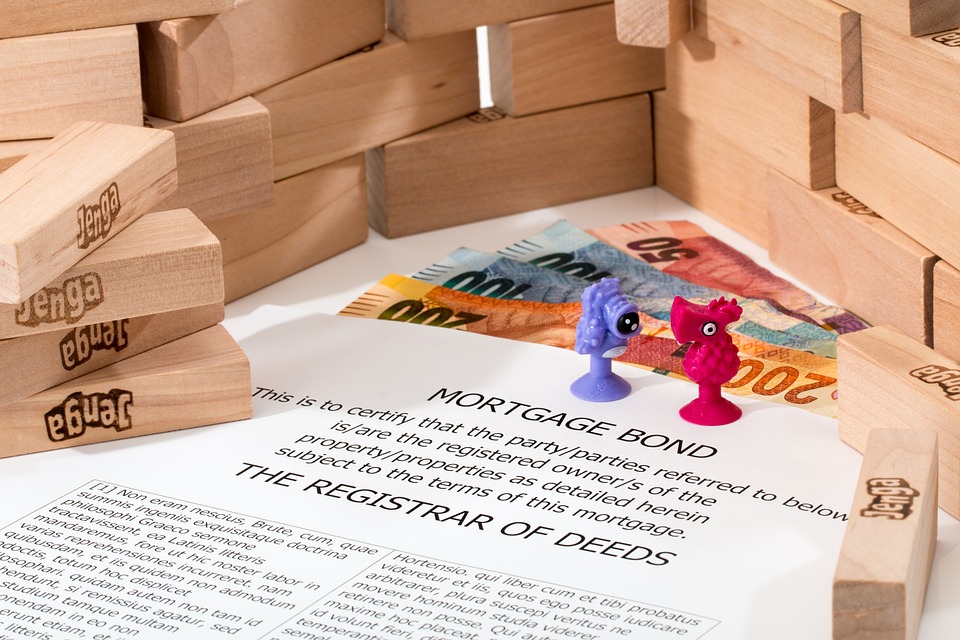

Before you start investing, it’s important to set clear financial goals. Do you want to save for retirement, buy a house, or build a college fund for your children? Knowing your goals will help you determine how much you need to invest and what type of investments are best suited to help you achieve those goals.

Once you have your goals in mind, the next step is to educate yourself about different investment options. Stocks, for example, are ownership shares in a company and can offer the potential for high returns but also come with a higher level of risk. Bonds, on the other hand, are debt securities issued by companies or governments and offer a more stable but lower return. Real estate and mutual funds are other popular investment options to consider.

It’s also important to understand the concept of risk and return. Generally, the higher the potential return on an investment, the higher the risk involved. It’s important to balance risk and return based on your financial goals and risk tolerance.

One of the most important things to remember when investing is to diversify your portfolio. Diversification means spreading your investments across different asset classes, industries, and regions to reduce risk. By diversifying your portfolio, you can protect yourself from the ups and downs of individual investments and increase your chances of earning a positive return over the long term.

Finally, it’s crucial to regularly review and adjust your investment portfolio. Markets are constantly changing, so it’s important to stay informed and make adjustments to your investments as needed. Consider working with a financial advisor to help you create a personalized investment strategy that aligns with your goals and risk tolerance.

In conclusion, investing can be a powerful tool for building wealth and achieving your financial goals. By understanding the basics of investing, setting clear goals, and diversifying your portfolio, you can set yourself up for success in the world of investing. Remember to stay informed, be patient, and seek guidance when needed to make the most of your investments.